Table of Content

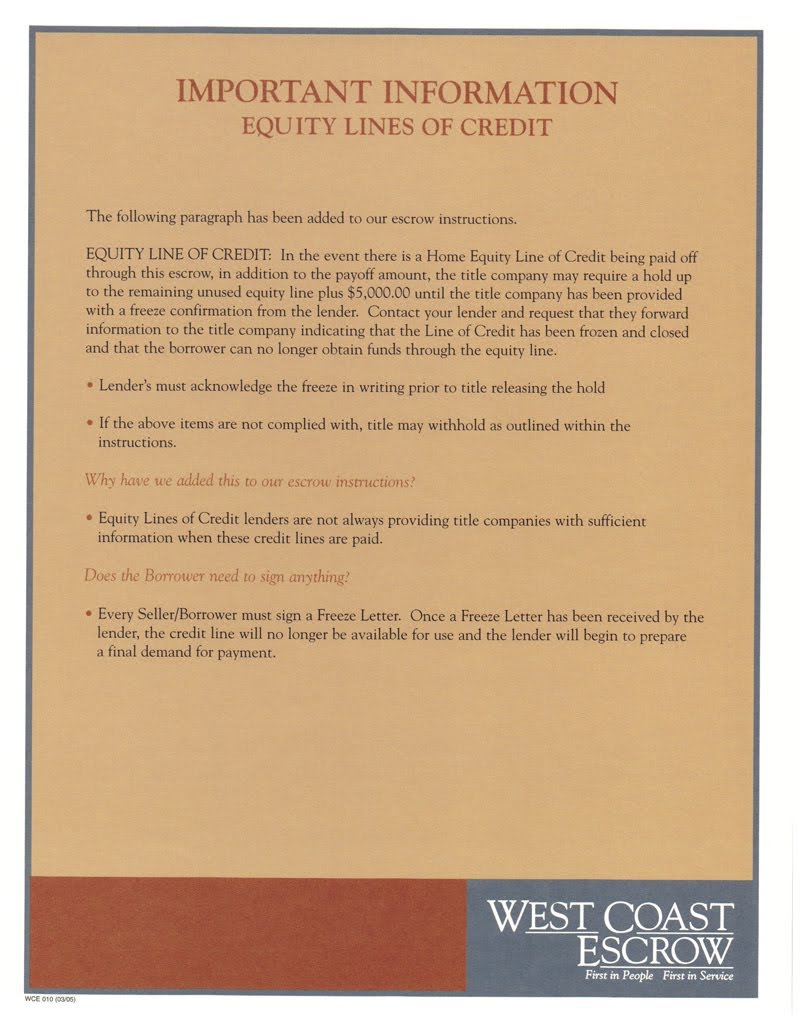

You’ll pay back the outstanding balance that you borrowed, as well as any interest owed. No matter which lender you choose, your credit score and market interest rates will affect what rate you can get on a HELOC fixed-rate option. Still, as with any loan, some lenders have lower rates than others. Shop around and don’t overlook credit unions and small banks, which sometimes have better deals than the big banks. Variable-rate HELOCs have an interest rate tied to a benchmark rate, often the prime rate, to which lenders add percentage points to establish a rate range. For example, the lowest variable rate could be prime + 1.5%, and the highest could be prime + 7.0%.

Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors. Get all of our latest home-related stories—from mortgage rates to refinance tips—directly to your inbox once a week. Another alternative is refinancing your first mortgage and your HELOC into a new mortgage. But if you go down this road, you’ll no longer have access to a line of credit.

Should You Consider A HELOC On Your Investment Property?

Scenarios when using a fixed-rate HELOC instead of a variable-rate one makes sense include the following four. To compare other options, check out our guide to the best HELOCs. Take control of your financial future with information and inspiration on starting a business or side hustle, earning passive income, and investing for independence. Each week, you'll get a crash course on the biggest issues to make your next financial decision the right one. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy.

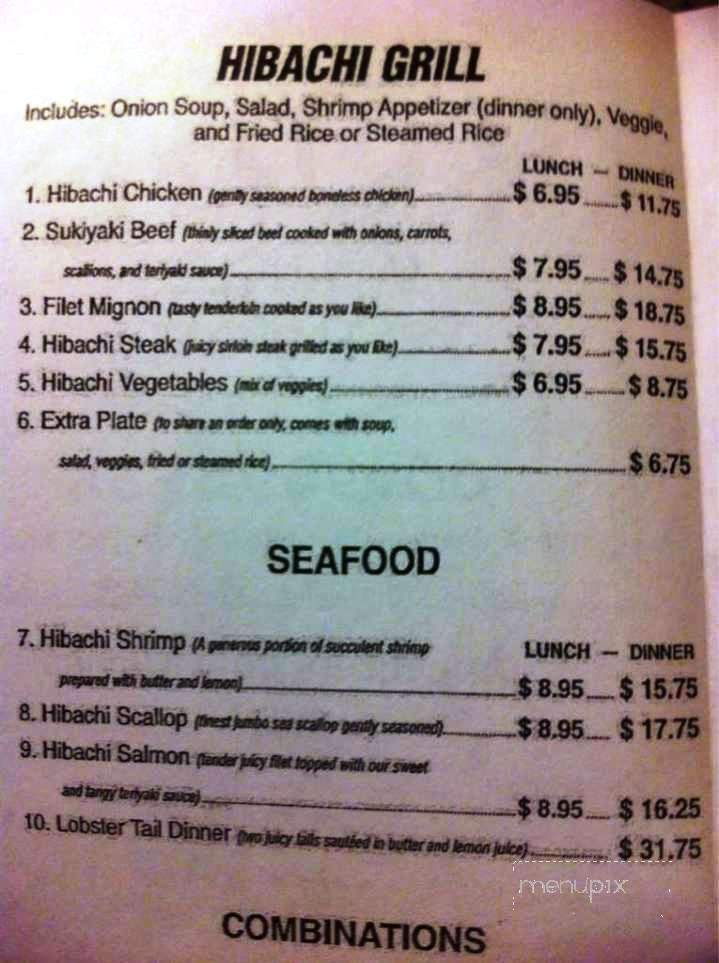

When you get a traditional variable-rate HELOC, you can make interest-only payments during the draw period then pay the interest and principal once the draw period ends. Based in the Southern and Midwestern United States, Regions Bank offers variable-rate HELOCs with the option to convert to fixed-rate loans. You can create up to 10 fixed-rate loans out of your HELOC, each with a balance as low as $5,000. A fixed-rate HELOC can prevent that from happening by locking in some or all of the remaining balance of your variable-rate HELOC at a particular interest rate.

Pros of getting a fixed-rate HELOC

For line amounts greater than $500,000, maximum combined loan-to-value ratios are lower and certain restrictions apply. Also, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. These ads are based on your specific account relationships with us. Consider a cash-out refinance loan to get the financing you need. Typically lower upfront costs than with home equity loans.

This table does not include all companies or all available products. Suzanne De Vita is the mortgage editor for Bankrate, focusing on mortgage and real estate topics for homebuyers, homeowners, investors and renters. We’ll find you a highly rated lender in just a few minutes. You may be limited in the number of times that you can lock a rate.

How often can the interest rate change on a HELOC?

Check if the lender charges for this increased flexibility through a higher interest rate or fees. For detailed information on how to complete the payoff process and to access required forms, please review our closing your account section. The lock is subject to fixed-rate pricing which may be higher than your current variable interest rate. Since you will be opening a new HELOC with Chase to pay off the balance of your current account, you can think of the refinancing process as a re-application. If all goes well, once the funds are transferred into your account you should be able to start using them as soon as possible.

Here are some of thekey considerations for getting a HELOC. Tuition or education costs - HELOCs often have lower interest rates than student loans, though some lenders may place restrictions on how you can use the funds. Large purchases - Because HELOCs have longer repayment periods than many loans, they may be an attractive choice for making large purchases.

Manage Your Loan

While adjustable-rate HELOCs and home equity loans have their upsides, there are certain advantages to a fixed-rate HELOC. Here are some of the ways you may find a locked-in rate on your loan beneficial. Sharing your property’s zip code will let us provide you with more accurate information. This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there.

So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. You can open up a new HELOC with your preferred interest rate and use those funds to pay off the original HELOC. Foremost, you can open a brand-new hybrid or fixed HELOC. This is likely the most straightforward way to obtain a HELOC with the interest rate you want. However, it’s best to do this if you’re at the end of your current HELOC’s draw period. Fixed-rate HELOCs come with many advantages that other lines of credit or loans do not have.

Some lenders charge a nominal fee, such as $50 or $100, when you lock in a fixed rate on a balance. Lenders will let you fix your rate for anywhere from one to 30 years. The longer the term, the smaller your monthly payment, but, all else being equal, the more interest you’ll pay. In addition to Investopedia, she has written for Forbes Advisor, The Motley Fool, Credible, and Insider and is the managing editor of an economics journal. She is a graduate of Washington University in St. Louis. Compare rates and payments for a variety of home equity options.

All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Some lenders will let you convert your fixed-rate loan back to a variable-rate loan anytime during the draw period, which you would want to do if interest rates dropped.

Some HELOCs come with a fixed-rate loan option, or FRLO, allowing you to convert all or part of the balance of your line of credit into a loan with a fixed interest rate. This can help you lock in a low rate, so you won’t have to worry about a variable rate going up in the future. There may be a limit on the number of fixed-rate loan options you can have at one time—usually three to five—and you'll want to inquire about whether conversion involves any fees.

However, unlike a HELOC that allows you to draw as much as you need over time, you receive the funds as one lump sum. So if you choose to explore home equity loans, you’ll need to know exactly how much you need to borrow upfront. Without automatic payments, the APR will be 5.50% or 5.65% for the first 24 or 36 months, respectively. Without automatic payments, the APR will be 5.85% or 5.95% for the first 48 or 60 months, respectively.

No comments:

Post a Comment